Crypto wallets are the gateway to managing your digital assets securely, but with so many options, choosing the right one can feel overwhelming. Whether you’re a beginner dipping your toes into Bitcoin or an experienced trader juggling multiple cryptocurrencies, understanding crypto wallets is crucial. This guide demystifies crypto wallets, breaking down their types, features, and how to pick the perfect one for you.

What Are Crypto Wallets?

A crypto wallet is a tool—software or hardware—that stores the private and public keys needed to interact with blockchain networks. Think of it as a digital vault for your cryptocurrencies, enabling you to send, receive, and manage assets like Bitcoin, Ethereum, or Solana.

Types of Crypto Wallets

Crypto wallets come in various forms, each with unique benefits and trade-offs. Here’s a quick breakdown:

- Hot Wallets: Software-based wallets connected to the internet (e.g., mobile or desktop apps). They’re convenient for frequent transactions but more vulnerable to hacks.

- Cold Wallets: Offline wallets, like hardware devices or paper wallets, offering top-tier security for long-term storage.

- Custodial Wallets: Managed by third parties (e.g., exchanges like Coinbase). They’re user-friendly but give you less control over your keys.

- Non-Custodial Wallets: You control your private keys, offering full ownership but requiring more responsibility.

Outbound Link: Learn more about blockchain basics at CoinDesk.

Why Choosing the Right Crypto Wallet Matters

Your crypto wallet is your first line of defense against theft, scams, and technical mishaps. A poorly chosen wallet could expose your funds to hackers or lock you out of your assets. For example, in 2023, over $3.7 billion was lost to crypto scams, often due to compromised hot wallets (source: Chainalysis). The right wallet balances security, convenience, and functionality based on your needs.

How to Choose the Best Crypto Wallet for You

Selecting a crypto wallet depends on your goals, technical comfort, and trading habits. Here’s how to make an informed choice:

1. Assess Your Needs

- Beginners: Opt for user-friendly custodial wallets like Coinbase Wallet or Trust Wallet.

- Active Traders: Hot wallets like MetaMask are ideal for quick transactions and DeFi interactions.

- Long-Term Investors: Cold wallets like Ledger Nano X provide unmatched security for HODLing.

2. Prioritize Security Features

Look for wallets with:

- Two-factor authentication (2FA).

- Multi-signature support for added protection.

- Regular software updates to patch vulnerabilities.

3. Check Compatibility

Ensure the wallet supports your preferred cryptocurrencies. For instance, MetaMask is great for Ethereum-based tokens, while Electrum specializes in Bitcoin.

4. Evaluate Ease of Use

If you’re not tech-savvy, choose wallets with intuitive interfaces. For example, Exodus offers a beginner-friendly design with robust features.

Outbound Link: Compare wallet features at CryptoCompare.

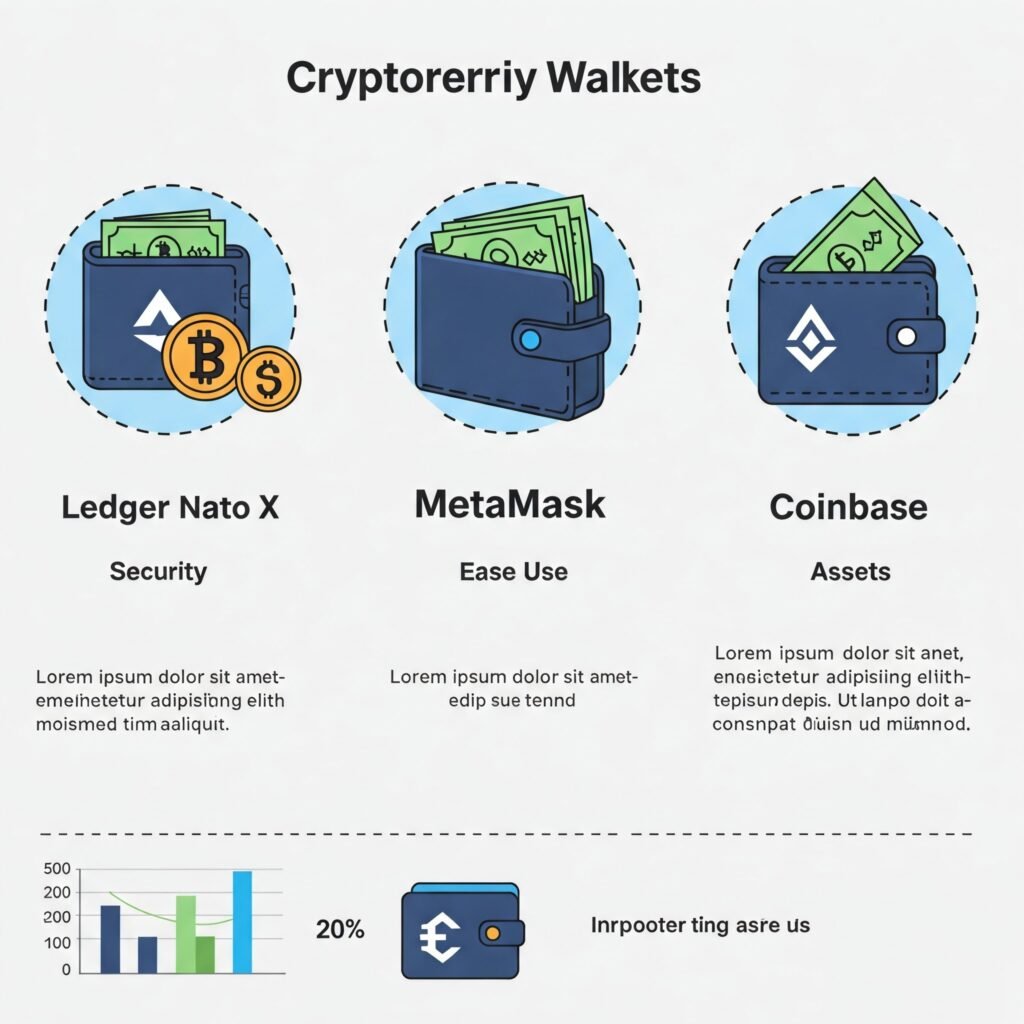

Top Crypto Wallets to Consider

Here are some of the best crypto wallets for different needs:

- Ledger Nano X (Cold Wallet)

- Best for: Security-conscious investors.

- Pros: Supports 5,500+ assets, Bluetooth connectivity, offline storage.

- Cons: Costs $149.

- Use Case: Storing large amounts of crypto securely.

- MetaMask (Hot Wallet)

- Best for: DeFi and NFT enthusiasts.

- Pros: Free, integrates with Ethereum dApps, browser extension.

- Cons: Vulnerable to phishing if not secured properly.

- Use Case: Frequent trading or interacting with decentralized apps.

- Coinbase Wallet (Custodial/Hot Wallet)

- Best for: Beginners.

- Pros: Easy to use, backed by a trusted exchange, supports multiple blockchains.

- Cons: Custodial nature means less control.

- Use Case: Starting your crypto journey.

Common Mistakes to Avoid with Crypto Wallets

Even the best crypto wallets can’t protect you if you make these errors:

- Not Backing Up Your Seed Phrase: Always store your 12-24 word recovery phrase offline. Losing it means losing access to your funds.

- Falling for Phishing Scams: Verify wallet websites and avoid clicking suspicious links.

- Ignoring Updates: Outdated wallet software can have exploitable bugs.

Outbound Link: Stay safe with tips from Kaspersky.

Actionable Takeaways for Crypto Wallet Success

To wrap up, here’s how to get started with crypto wallets:

- Decide if you need a hot or cold wallet based on your trading frequency.

- Research wallets with strong security and compatibility for your assets.

- Test a wallet with a small amount of crypto before transferring large sums.

- Always secure your seed phrase in a safe, offline location.

By choosing the right crypto wallet, you’re not just safeguarding your assets—you’re setting yourself up for a seamless crypto experience.