Financial literacy is the key to taking control of your money and building a secure future. Whether you’re just starting out or looking to level up your money management skills, understanding how to budget, save, and invest can transform your financial life. This guide breaks down financial literacy into simple, actionable steps so you can manage money like a pro—no finance degree required!

Why Financial Literacy Matters

Financial literacy empowers you to make informed decisions about your money. According to a 2023 National Financial Educators Council report, 65% of Gen Z and Millennials feel unprepared to manage their finances. Without financial literacy, it’s easy to fall into debt traps or miss wealth-building opportunities.

Mastering money management means:

- Gaining confidence in your financial decisions.

- Avoiding costly mistakes like overspending or high-interest debt.

- Building a foundation for long-term wealth.

Step 1: Create a Budget to Master Money Management

A budget is your financial roadmap. It helps you track income, expenses, and savings to ensure you’re living within your means.

How to Build a Budget

- Track Your Income: Calculate your monthly take-home pay.

- List Expenses: Include fixed costs (rent, utilities) and variable costs (groceries, entertainment).

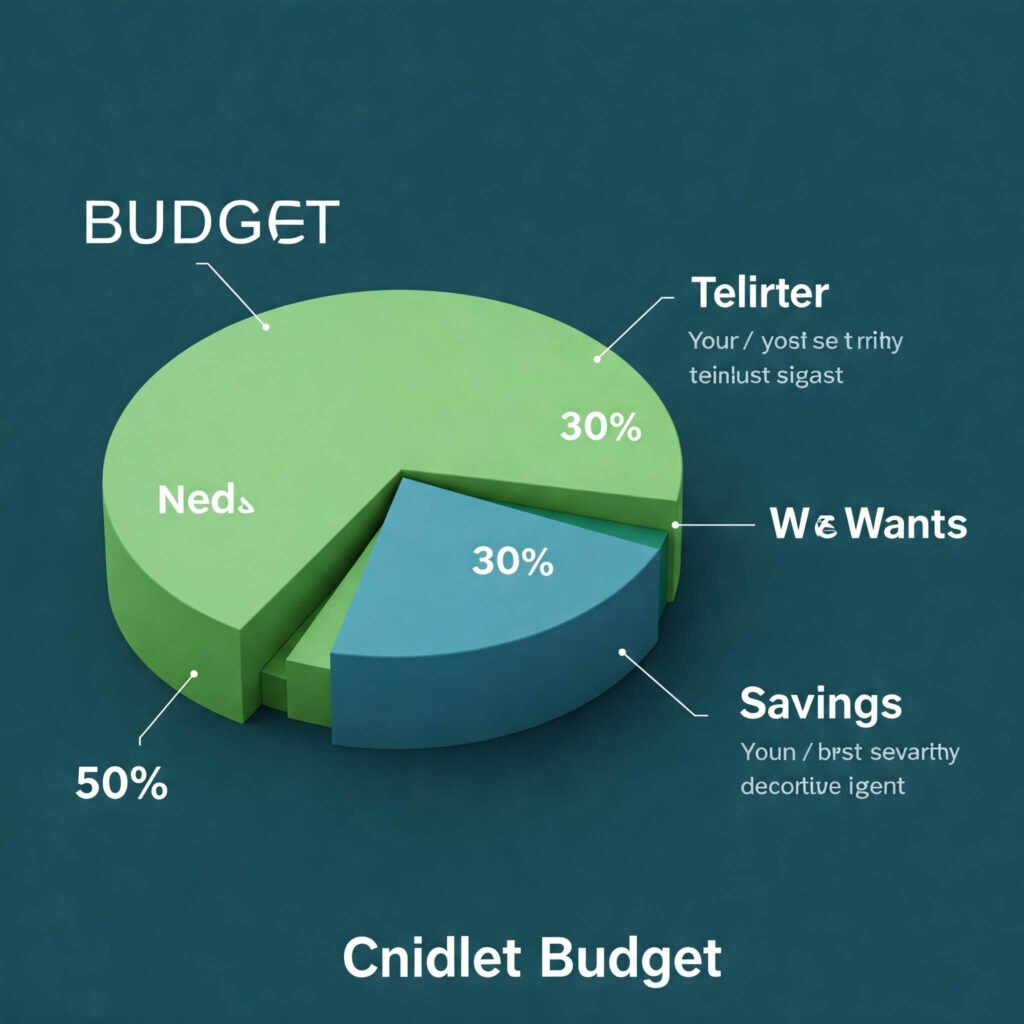

- Follow the 50/30/20 Rule: Allocate 50% to needs, 30% to wants, and 20% to savings or debt repayment.

- Use Budgeting Tools: Apps like YNAB or Mint simplify tracking.

Real-World Example: Sarah, a 28-year-old teacher, used the 50/30/20 rule to pay off $5,000 in credit card debt in one year by cutting dining-out expenses and redirecting funds to debt repayment.

Step 2: Save Smart with Financial Literacy

Saving isn’t just about stashing cash—it’s about preparing for emergencies and future goals.

Top Saving Tips

- Build an Emergency Fund: Aim for 3-6 months of living expenses. Start small with $500.

- Automate Savings: Set up automatic transfers to a high-yield savings account.

- Set Goals: Save for specific purposes, like a vacation or a home down payment.

Pro Tip: Check out Ally Bank for high-yield savings accounts with competitive interest rates.

Step 3: Invest to Grow Your Wealth

Investing is a cornerstone of financial literacy. It’s how your money works for you over time.

Getting Started with Investing

- Understand the Basics: Stocks, bonds, and mutual funds are common options.

- Start Small: Use platforms like Robinhood or Acorns for beginner-friendly investing.

- Diversify: Spread investments across different assets to reduce risk.

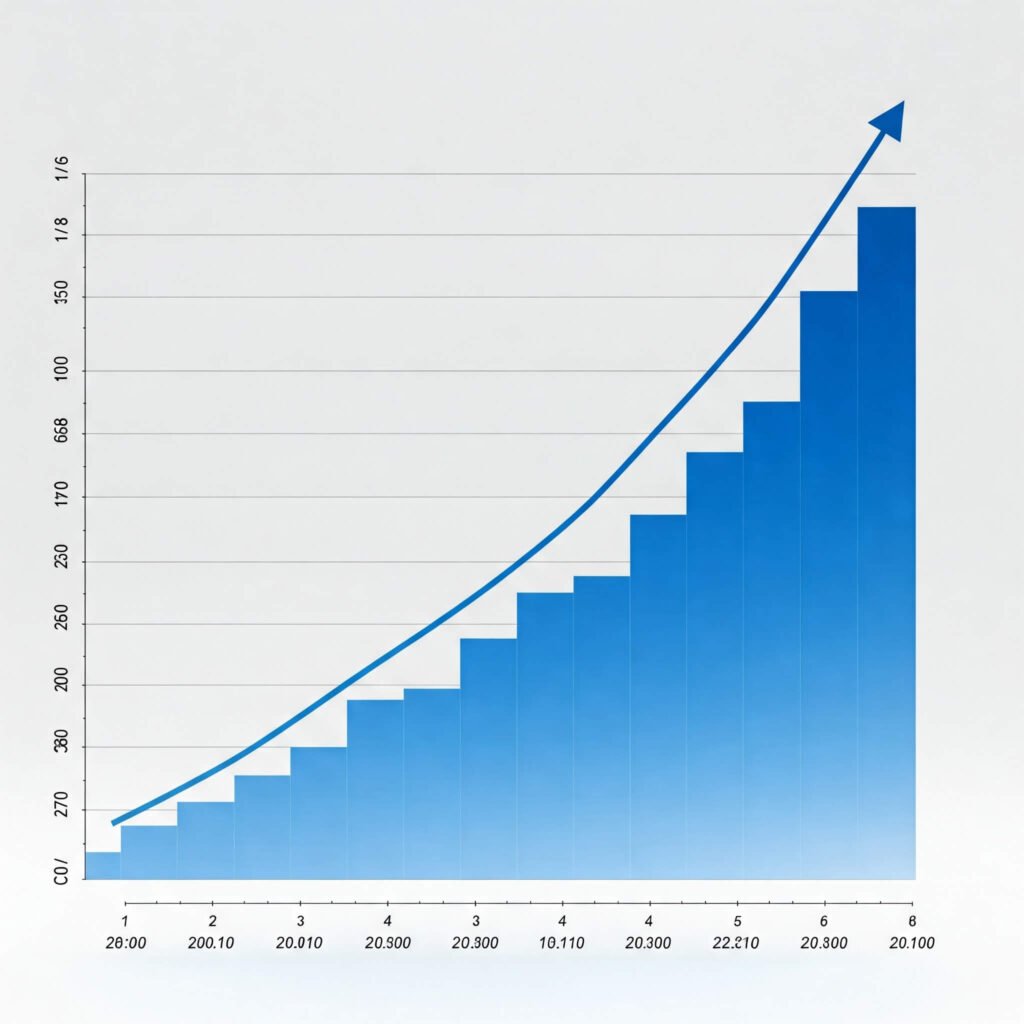

- Think Long-Term: Compounding interest grows wealth over decades.

Data Insight: A Vanguard study shows that investing $100 monthly at a 7% annual return could grow to $150,000 in 30 years.

Step 4: Manage Debt Like a Pro

Debt can derail your financial goals, but financial literacy equips you to tackle it strategically.

Debt Management Strategies

- Prioritize High-Interest Debt: Pay off credit cards or payday loans first.

- Use the Snowball Method: Pay smallest debts first for quick wins.

- Consolidate Debt: Combine multiple debts into one lower-interest loan.

Real-World Example: John consolidated $10,000 in credit card debt into a personal loan with a lower interest rate, saving $1,200 in interest over two years.

Key Takeaways for Financial Literacy

Mastering financial literacy is about small, consistent steps. Here’s how to start today:

- Create a budget using the 50/30/20 rule.

- Save automatically for emergencies and goals.

- Invest early to leverage compound interest.

- Tackle debt strategically to free up income.

By applying these principles, you’ll manage money like a pro and build a brighter financial future.

Outbound Links: Investopedia – Financial Literacy: