Introduction to Personal Finance 101

Want to build wealth over time? Personal Finance 101 is all about adopting simple, consistent habits that lead to financial freedom. Whether you’re just starting or looking to level up, small actions today can compound into significant wealth tomorrow. This guide breaks down actionable habits to help you get rich—without needing a finance degree. Let’s dive into the strategies that work, backed by real-world examples and data.

Why Personal Finance 101 Matters

Mastering personal finance 101 isn’t about quick wins—it’s about long-term discipline. According to a 2023 Federal Reserve study, 60% of Americans lack enough savings for a $1,000 emergency. Adopting smart financial habits can change that. These habits aren’t flashy, but they’re proven to build wealth over time.

The Power of Small Financial Habits

Small actions, like saving 10% of your income or cutting one subscription, add up. Take Sarah, a teacher who saved $200 monthly for 20 years. With a modest 7% annual return, she grew her savings to over $100,000. That’s the magic of consistency in personal finance 101.

Habit 1: Budget Like a Pro to Build Wealth

A budget is your roadmap to get rich. It’s not about deprivation—it’s about control. Tools like YNAB or Mint make budgeting simple.

Steps to Create a Budget

- Track Income and Expenses: List all income sources and monthly expenses.

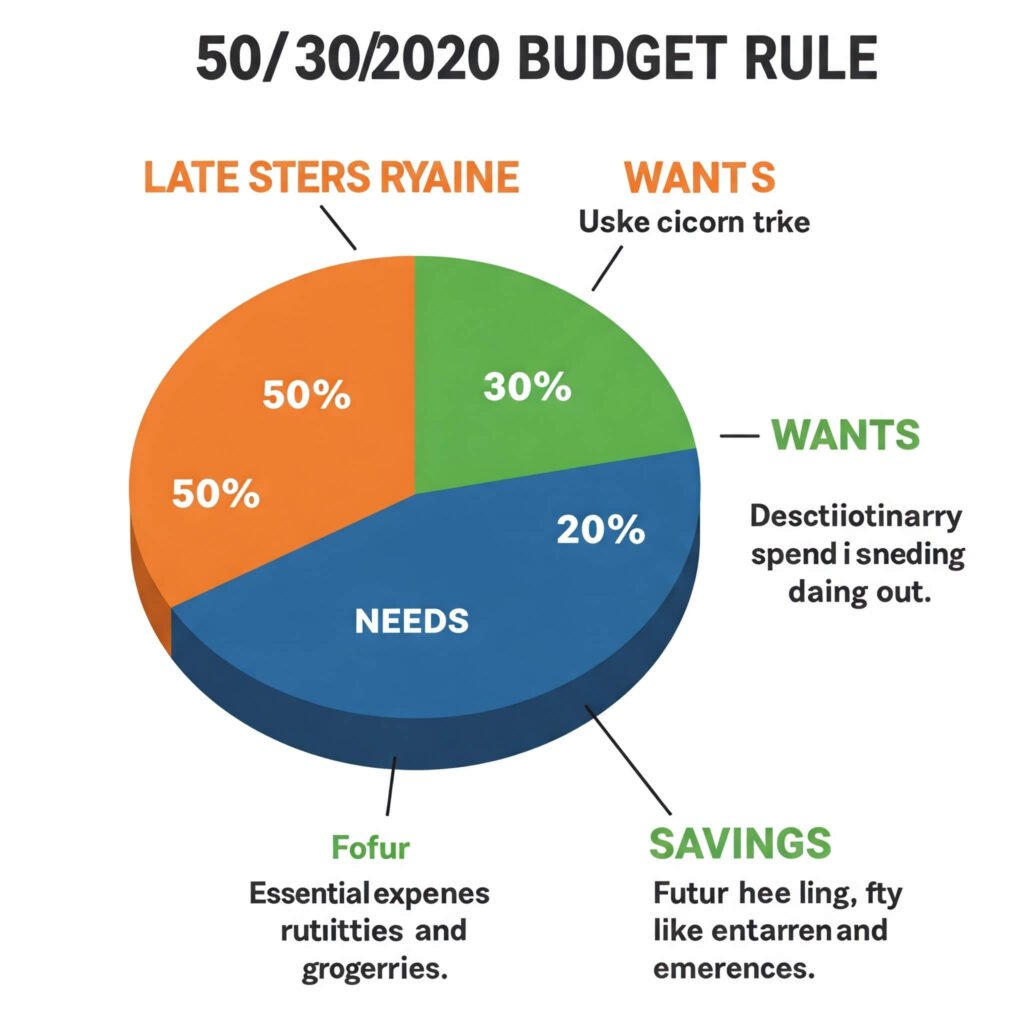

- Use the 50/30/20 Rule: Allocate 50% to needs, 30% to wants, and 20% to savings or debt repayment.

- Review Monthly: Adjust as needed to stay on track.

Pro Tip: Automate savings transfers to prioritize wealth-building.

Habit 2: Save First, Spend Later

Saving before spending is a cornerstone of personal finance 101. Treat savings like a bill—non-negotiable. Aim to save at least 10-20% of your income.

How to Save More

- Set Up Automatic Transfers: Move money to savings right after payday.

- Use High-Yield Savings Accounts: Earn 4-5% interest with accounts from Ally Bank or Marcus.

- Start Small: Even $50 a month adds up over time.

Example: John, a barista, saved $100 monthly in a high-yield account. After 10 years, he had $15,000—enough for a down payment on a car.

Habit 3: Invest Wisely to Get Rich

Investing is how you make your money work for you. In personal finance 101, the earlier you start, the better. The S&P 500 has averaged a 10% annual return over the past century, per Investopedia.

Beginner-Friendly Investment Options

- Index Funds: Low-cost, diversified, and beginner-friendly. Try Vanguard or Fidelity.

- Retirement Accounts: Max out your 401(k) or IRA for tax benefits.

- Robo-Advisors: Platforms like Betterment automate investing.

Real-World Win: Maria invested $5,000 annually in an index fund starting at age 25. By 65, she had over $1 million, thanks to compound interest.

Habit 4: Avoid Lifestyle Inflation

As income rises, so does spending—unless you fight it. Personal finance 101 teaches you to live below your means to build wealth.

Tips to Avoid Lifestyle Creep

- Stick to Your Budget: Don’t upgrade your lifestyle with every raise.

- Invest Raises: Put extra income into savings or investments.

- Practice Gratitude: Appreciate what you have to curb impulse buys.

Example: Alex, a software engineer, kept his expenses steady despite a 30% raise. He invested the extra income, growing his net worth by $50,000 in five years.

Habit 5: Pay Off High-Interest Debt

Debt with high interest (like credit cards) eats away at your ability to get rich. The average credit card interest rate is 20%, per Forbes.

Debt Payoff Strategies

- Avalanche Method: Pay off high-interest debt first to save money.

- Snowball Method: Tackle smallest debts first for quick wins.

- Consolidate Debt: Use low-interest loans to simplify payments.

Pro Tip: Negotiate with creditors for lower rates—it works more often than you think.

Conclusion: Start Your Personal Finance 101 Journey Today

Building wealth doesn’t require a windfall—it requires smart habits. By budgeting, saving, investing, avoiding lifestyle creep, and tackling debt, you can get rich over time. Start small, stay consistent, and watch your wealth grow. What’s one personal finance 101 habit you’ll adopt today?

Outbound Links: 5 Financial Habits for Long-Term Success | Bral Niedert Private Wealth Advisors: